CRA Login [My CRA Account Login]

Using the CRA Login is super important for people and businesses. The Canada Revenue Agency (CRA) is like the tax boss of the government. It looks after all the tax rules, makes sure people get benefits, and handles different money programs for Canadians. The CRA was set up to make sure taxes are fair for everyone. It collects taxes, gives out tax credits and benefits, and helps people follow tax rules. But it’s not just about taxes; the CRA also manages things like the Canada Child Benefit and the Goods and Services Tax/Harmonized Sales Tax (GST/HST) credit.

Table of Contents

ToggleCRA is like the money helper for Canadians. It handles tax-related benefits and programs, making sure everyone follows the money rules set by the government. The CRA works not just for the national government but also helps out the provinces and territories.

For regular folks, businesses, and people like accountants who work with taxes, the CRA does a bunch of things. It takes in and looks at tax forms and benefit requests, checks if the money stuff is correct, gives out official papers like assessment notices, collects taxes, and figures out benefits, such as the Canada Child Benefit. Basically, the CRA helps keep everything money-related in order for everyone.

Additionally, people can log in to their accounts using their CRA user ID and passwords. With the CRA login, individuals can keep tabs on their tax refunds, see their credit payments, check their RRSP limit, arrange for direct deposits, and access various other important services.

CRA Account Login

The Canada Revenue Agency provides three methods for signing in – CRA Sign In, Sign In Partner, and Provincial Partner Sign In. If you’re a new user, you need to finish your registration by giving the necessary and accurate information.

To access your CRA account, there are two main methods:

1. Using a Sign-In Partner:

- Visit the CRA login page: https://www.canada.ca/en/revenue-agency/services/e-services/cra-login-services.html

- Choose “Sign in with a partner.”

- Pick your bank or participating organization from the list.

- Follow the on-screen instructions to log in with your existing credentials.

2. Using a CRA User ID and Password:

- Visit the CRA login page: https://www.canada.ca/en/revenue-agency/services/e-services/cra-login-services.html

- Select “Sign in with CRA user ID and password.”

- Enter your CRA user ID and password.

- If prompted, enter your CRA security code (a 9-digit number received by mail during registration).

Important Security Tips:

- Never share your CRA user ID, password, or security code.

- Be cautious of phishing scams; the CRA won’t ask for personal info via email or text.

- Keep your software and antivirus up to date.

Additional Resources:

- CRA Registration Process: https://www.canada.ca/en/revenue-agency/services/e-services/digital-services-individuals/account-individuals.html

- CRA Sign-In Services: https://www.canada.ca/en/revenue-agency/services/e-services/cra-login-services.html

CRA My Account login

The Canada Revenue Agency (CRA) My Account portal acts as a safe and handy center for handling your personal tax details and benefits. Logging in opens up numerous useful features, but for first-timers, the process may seem overwhelming. This guide aims to simplify the CRA My Account login, ensuring a seamless and secure experience.

Accessing Your Account:

To access your CRA My Account, there are two main ways:

- Sign-In Partner: This option uses your existing credentials from participating financial institutions. Choose your bank from the list on the CRA login page and follow the usual prompts. Remember to ensure you’re on the official CRA website before entering any details.

- CRA User ID and Password: This method needs a dedicated CRA user ID and password, obtained through a simple registration process. Visit the CRA website, select “Sign in with CRA user ID and password,” and follow the steps. Keep your login details private and avoid sharing them.

Security First:

The CRA takes your financial data’s security seriously. Here are some crucial security tips:

- Never share your CRA user ID, password, or security code.

- Watch out for phishing scams; the CRA won’t ask for personal info via email or text.

- Keep your software and antivirus updated.

- Change your password regularly and use strong, unique combinations.

Unlocking the Features:

Once logged in, your CRA My Account dashboard offers various possibilities:

- Check your tax return status and file online.

- Make online tax payments.

- Access and update your personal details.

- Register for direct deposit of refunds and benefits.

- Manage your Canada Child Benefit (CCB) payments.

- View and track your RRSP contribution limits.

Additional Resources:

For more help or detailed info, explore these resources:

- CRA My Account registration: https://www.canada.ca/en/revenue-agency/services/e-services/digital-services-individuals/account-individuals.html

- CRA sign-in services: https://www.canada.ca/en/revenue-agency/services/e-services/cra-login-services.html

By following these guidelines and using the available resources, you can confidently navigate the CRA My Account login process and enjoy the benefits of this secure online platform. Always remember, protecting your financial information is crucial, so prioritize security with utmost care.

Also, Check: CRA Login For Individuals

Digital Services Of CRA login

The CRA login portal provides various digital services tailored to different groups. Here’s a quick summary of what each group can access:

For Individuals:

- File or edit a return: Submit or make changes to your income tax return online.

- View and manage My Account: Access personal tax details, including returns, assessments, and benefit payments.

- Receive email notifications: Stay updated on deadlines, messages, and tax file changes.

- Submit documents: Upload supporting files for your tax return or other requests.

- Calculate family benefits: Estimate eligibility for benefits like Canada Child Benefit (CCB).

- Make a payment: Settle tax payments through various online methods.

- Manage direct deposit: Set up or update direct deposit information for refunds and benefits.

- Track file progress: Monitor the status of tax return, documents, and other submissions.

For Businesses:

- File a return: Electronically submit GST/HST, corporate income tax, and payroll deduction returns.

- Make a payment: Settle business tax payments online.

- Register a business: Sign up for GST/HST, payroll deductions, and other tax requirements.

- Get information: Access details about business taxes, benefits, and compliance requirements.

- Make online requests: Seek rulings, submit objections, or make inquiries online.

- Calculate payroll deductions: Use the CRA’s calculator for employee income tax, CPP, and EI.

- Download forms and publications: Access various business-related tax forms and publications.

- Submit documents: Upload supporting files for business tax returns or other requests.

- Track file progress: Monitor the status of business tax returns, documents, and other submissions.

For Large Corporations and Multinational Enterprises:

- Submit enquiries: Ask about complex tax matters or specific situations.

- Respond to notices: Reply to assessment or reassessment notices and other communications.

- Submit documents: Upload complex documents and data related to tax affairs.

- Submit audit enquiries: Request information or clarification during an audit process.

- Authorize online information access: Grant authorized representatives access to online tax information.

For Tax Preparers:

- File returns or payments: Submit tax returns and payments on behalf of clients.

- Get information: Access resources specific to tax preparers.

- Subscribe to mailing list: Stay informed about updates and news relevant to tax preparers.

- Download forms and publications: Access tax forms and publications for clients.

For Charities and Donors:

- Search for a registered charity: Find information about registered charities in Canada.

- Calculate donation tax credits: Estimate tax credits for donations to registered charities.

- Change a charity’s address: Update contact information for a registered charity.

CRA Business Login

As a business owner or representative in Canada, the CRA Business Login acts as your gateway to crucial tax information and services. Although the process shares similarities with the individual My Account login, navigating it requires specific knowledge. This guide aims to equip you with a clear understanding, ensuring a seamless and secure login experience.

Accessing Your Account:

There are two primary ways to access your CRA Business Account:

- Sign-In Partner: Use your existing credentials from partnering financial institutions for a smooth login. Choose your bank from the list on the CRA login page and follow the familiar prompts. Always ensure you’re on the official CRA website before entering any information.

- CRA User ID and Password: This method involves using a dedicated CRA user ID and password obtained through registration. Visit the CRA website, select “Sign in with CRA user ID and password,” and follow the steps. Keep your login credentials confidential and never share them.

Business Requirements:

To access your CRA Business Account, you’ll need:

- Your CRA User ID and password: Ensure they’re associated with your Business Number (BN).

- A Business Number (BN): This unique identifier connects your business to the CRA.

Additional Security Measures:

Beyond personal login information, businesses often require enhanced security protocols. These may include:

- Multi-factor authentication (MFA): An extra layer of security requiring a code from your mobile device or security token.

- Represent a Client service: Allows employees or representatives to securely access client accounts with proper authorization.

Unlocking the Features:

Once logged in, your CRA Business Account dashboard offers a range of valuable features:

- File corporate tax returns and make payments electronically.

- Register for GST/HST and payroll accounts.

- View and manage payroll deductions and remittances.

- Access excise tax and other levy accounts.

- Manage Represent a Client permissions and access.

- Update your business contact information.

Additional Resources:

For further assistance or detailed information, explore the following resources:

- CRA Business Account: https://www.canada.ca/en/revenue-agency/services/e-services/digital-services-businesses/business-account.html

- CRA Sign-in Services: https://www.canada.ca/en/revenue-agency/services/e-services/cra-login-services.html

By following these guidelines and using the available resources, you can confidently navigate the CRA Business Login process and efficiently manage your business finances. Remember, security is paramount, so stay vigilant in protecting your sensitive business information.

CRA Login Personal

Simplifying your personal tax and benefit management in Canada is easy with the CRA My Account login, providing a secure and convenient online platform. Whether you’re a seasoned user or just starting, this guide will provide you with the knowledge to smoothly and securely navigate the login process.

Accessing Your Account:

There are two main ways to access your CRA My Account:

- Sign-In Partner: For a straightforward experience, use your existing credentials from participating financial institutions like banks. Choose your bank on the CRA login page and follow the familiar prompts. Always prioritize security; make sure you’re on the official CRA website before entering any information.

- CRA User ID and Password: This method requires a dedicated CRA user ID and password, obtained through a simple registration process. Visit the CRA website, choose “Sign in with CRA user ID and password,” and follow the steps. Keep your login details private and never share them.

Unlocking the Features:

Once logged in, your CRA My Account dashboard opens up a range of valuable features that simplify your tax and benefit management:

- View your tax return status and file electronically.

- Make online tax payments.

- Access and update your personal information.

- Register for direct deposit of refunds and benefits.

- Manage your Canada Child Benefit (CCB) payments.

- View and track your RRSP contribution limits.

Security First:

The CRA prioritizes protecting your sensitive financial data. Here are some crucial security tips:

- Never share your CRA user ID, password, or security code.

- Be cautious of phishing scams; the CRA will never request personal information via email or text message.

- Keep your software and antivirus updated.

- Change your password regularly and use strong, unique combinations.

By following these guidelines and utilizing the available resources, you can confidently navigate the CRA My Account login process and make tax and benefit management a breeze. Remember, your financial security is crucial, so stay vigilant in protecting your personal information.

CRA Careers Login

Dreaming of joining Canada’s public service with the Canada Revenue Agency (CRA)? The CRA Careers Login is your key to exploring and applying for exciting job opportunities within the organization. This guide aims to simplify the login process and offer useful insights to help you navigate it smoothly.

Accessing the Login:

There are two main ways to access the CRA Careers Login:

- CRA User ID and Password: Get a special CRA user ID and password by registering on the CRA website. Visit CRA Careers [https://www.canada.ca/en/revenue-agency/corporate/careers-cra.html] and click “Sign in or register.” Choose “CRA register,” pick your candidate type, and keep your login details secret.

- Sign-In Partner: For an easy experience, use your existing credentials from participating banks. Click “Sign in with a partner” and choose your bank. Follow the familiar steps to access the platform.

Eligibility and Registration:

Before diving into login options, make sure you meet basic eligibility for CRA positions. This often includes Canadian citizenship or permanent residency, relevant education and experience, and language proficiency. Creating a candidate profile is important regardless of your login method. It lets you save info, set job alerts, and manage applications easily.

Unlocking Features:

Once logged in, the CRA Careers platform lets you:

- Check out a full list of current job postings in various areas.

- Search for specific opportunities based on your interests and qualifications.

- Read detailed job descriptions and apply online quickly.

- Manage your applications, track their progress, and get updates.

- Learn about upcoming career events and recruitment initiatives.

By understanding the login process, using available resources, and staying informed about upcoming opportunities, you can confidently navigate the CRA Careers platform and kickstart your fulfilling career in Canada’s public service. Remember, careful preparation and effectively presenting your qualifications increase your chances of landing your dream job at the CRA.

CRA Login Represent A Client

If you’re a legal or authorized representative managing Canadian tax matters for clients, the CRA’s “Represent a Client” service helps you handle their accounts online efficiently. This guide breaks down the login process, highlights key features, and gives essential security tips for a smooth and secure experience.

Accessing the Service:

Completing the Two Steps for CRA Account Access:

Step 1 – Providing Personal Information:

- Enter your Social Insurance Number.

- Add your date of birth.

- Input the amount from line 15000 that you reported on your most recent tax return (either from the current or previous tax year). Make sure the return has been filed and assessed.

- Provide an amount from one of your income tax and benefit returns. The requested line amount may vary, coming from either the current or previous tax year.

- Create a CRA user ID and password.

- Set up your security questions and answers. Decide if you want a persistent cookie on your computer for future convenient access.

- Enroll in mandatory Multi-factor authentication by choosing your preferred method (telephone, passcode grid, or a third-party authenticator app). It’s recommended to have more than one option on file, although one is required.

Step 2 – Entering the CRA Security Code:

To access your account, return to Represent a Client, select “CRA sign in,” and input your CRA user ID and password. When prompted, enter your CRA security code.

Alternatively, you can use a Sign-In Partner for CRA sign-in services. This lets you use existing sign-in information, like online banking details. For more details, refer to Sign-In Partners Help and FAQs.

Authorization is Key:

Before getting into a client’s account, you must get their clear authorization through the CRA’s authorization process. This ensures their privacy and security are protected. Different authorization methods exist, depending on the specific service you’re providing. Visit https://www.canada.ca/en/revenue-agency/services/tax/representative-authorization/overview.html for details.

Features at Your Fingertips:

Once authorized, “Represent a Client” lets you do various things on behalf of your client:

- View and manage their tax info and returns.

- File their tax returns online.

- Make online tax payments.

- Respond to CRA messages and requests.

- Access and update their contact info.

- Manage Represent a Client authorizations for other representatives.

Security First:

Protecting your clients’ financial info is super important. Here are some crucial security tips:

- Never share your CRA user ID, password, or security code.

- Watch out for phishing scams; the CRA won’t ask for personal info through email or text.

- Keep your software and antivirus updated.

- Only access authorized client accounts and use two-factor authentication where available.

- Keep your client info super confidential.

Additional Resources:

For more help or details, check out these resources:

- CRA Represent a Client service

- Representative Authorization Overview : https://www.canada.ca/en/revenue-agency/services/tax/representative-authorization/overview.html

By understanding the login process, following security guidelines, and using the available resources, you can efficiently use “Represent a Client” to make your work easier and provide great service to your clients. Always remember, trust and security are crucial, so handle client info with the utmost care and responsibility.

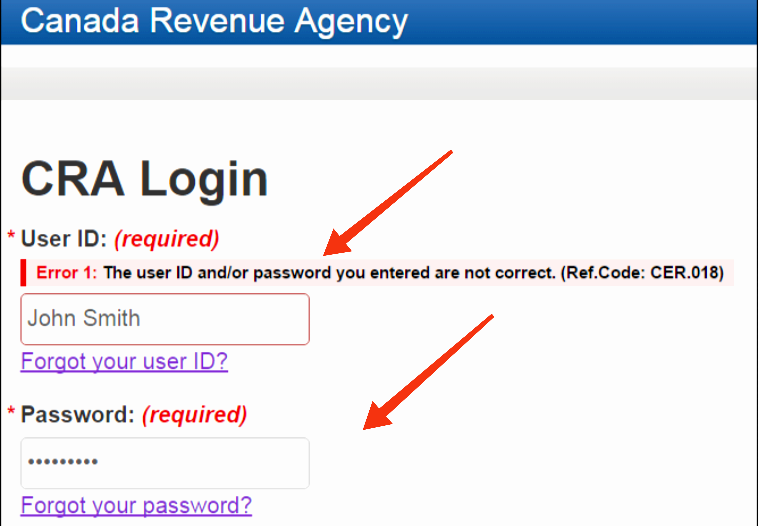

Why Is CRA Login Not Working

Encountering problems with your CRA login? Here are some common reasons and troubleshooting steps to help you regain access:

Common Reasons for CRA Login Issues:

- Downtime: The CRA website occasionally undergoes scheduled maintenance, temporarily disabling the login. You can check their maintenance schedule https://www.canada.ca/en/revenue-agency/services/e-services/cra-login-services/outage-details.html.

- Incorrect Login Credentials: Ensure your username and password are accurate, paying attention to capitalization and avoiding exceeding the allowed login attempts.

- Technical Issues: Browser compatibility, outdated software, or internet connectivity problems can disrupt the login process.

- Security Measures: The CRA prioritizes security, and if you haven’t logged in for a while or triggered security flags, your account might be temporarily locked.

Troubleshooting Steps:

- Check the Outage Schedule: Visit the provided link to see if the CRA website is currently undergoing maintenance.

- Verify Your Login Credentials: Double-check your username and password, paying close attention to capitalization and special characters.

- Clear Your Browser Cache and Cookies: This step can resolve issues caused by outdated data.

- Try a Different Browser or Device: If the problem persists, attempt the login on a different browser or device.

- Update Your Software: Ensure your browser and operating system are updated to the latest versions.

- Contact the CRA: If issues persist, directly contact the CRA for assistance. Reach them by phone at 1-800-959-8281 or through their online form.

Additional Tips:

- Be Aware of Phishing Scams: The CRA will never solicit personal information via email or text. Only provide login credentials on the official CRA website.

- Use Strong and Unique Passwords: Avoid easily guessable information like birthdays or common words.

- Enable Two-Factor Authentication: Add an extra layer of security to your account.

MyCRA Mobile App

While the CRA Login portal is your go-to for tax and benefit management, the MyCRA mobile app provides a handy option to access vital information and complete tasks on the fly. This guide dives into the app’s features, showcasing its advantages and how it can make your tax experience more straightforward.

What’s the MyCRA Mobile App?

The MyCRA mobile app is a secure and free application for iOS and Android devices. It offers personalized access to your Canadian tax details, enabling you to:

- Check your tax balance: Keep an eye on outstanding payments and track your refund status.

- Make secure payments: Conveniently settle your tax dues using various payment methods.

- Access tax return info: Review past and current returns, view assessments, and find key details.

- Get personalized notifications: Stay updated on important deadlines, messages, and upcoming tax events.

- Find tax prep clinics: Locate nearby clinics if you need help filing your return.

- Manage communication preferences: Choose how you receive updates and notifications from the CRA.

Benefits of Using the MyCRA Mobile App:

- Convenience: Manage taxes anytime, anywhere, directly from your mobile device.

- Security: Enjoy robust security and two-factor authentication for safe access.

- Efficiency: Quickly view vital info and complete basic tasks without a computer.

- Accessibility: User-friendly interface optimized for mobile devices.

Important Points to Remember:

- The app offers a subset of features compared to the full CRA Login portal for more complex tasks.

- A My Account login is needed to access the app, so have your credentials ready.

- Stable internet connection is necessary for the app to function correctly.

Getting Started with the MyCRA Mobile App:

- Download the app from the App Store or Google Play Store.

- Log in with your My Account credentials.

- Follow on-screen instructions to complete your profile and security settings.

- Explore the app’s features and get familiar with the layout.

Staying Informed:

Stay updated on future app updates and features through the CRA website, social media, and email notifications.

In Conclusion:

The MyCRA mobile app offers a secure and handy way to manage essential tax tasks on the go. Understanding its features, benefits, and limitations helps you decide if it suits your tax management needs. Keep in mind responsible security practices, and find more about securing your CRA login on the CRA website.

CRA BizzApp Mobile App

The CRA BizApp is a free mobile application crafted by the Canada Revenue Agency (CRA), specially tailored for small business owners and sole proprietors. It offers a secure and convenient way to manage your business tax affairs and accomplish vital tasks on the go. Here’s a breakdown of key information about the CRA BizApp:

What it does:

- View and manage business accounts: Monitor account balances, transaction history, and expected GST/HST returns.

- Make secure payments: Conveniently settle your tax obligations using various payment methods.

- File payroll remittances: Electronically submit T4 slips and other payroll information.

- Access tax documents: Download and store essential tax slips and notices.

- Receive personalized notifications: Stay updated on deadlines, new messages, and upcoming events.

Getting started:

- Meet the requirements: Be a small business owner or sole proprietor with a valid social insurance number.

- Download the app: Available for free on iOS and Android devices.

- Register for a My Account: If you don’t have one, create a CRA My Account online.

- Enroll in the app: Provide personal information, create login credentials, and choose your preferred multi-factor authentication method.

- Receive a security code: The CRA will send a unique code to your email or phone.

- Log in and access features: Utilize your login credentials and the security code to access the app’s functionalities.

Benefits of using the CRA BizApp:

- Convenience: Manage business taxes from your mobile device anytime, anywhere.

- Security: Robust security measures and two-factor authentication ensure data protection.

- Efficiency: Quickly access key information and complete common tasks without needing a computer.

- Accessibility: A user-friendly interface simplifies navigation and information access.

Things to keep in mind:

- The CRA BizApp offers a subset of features compared to the full My Account portal; for complex tasks, the online portal may be required.

- A My Account login is necessary to access the app.

- The app requires a stable internet connection for proper functioning.

Additional resources:

- CRA BizApp website: https://www.canada.ca/en/revenue-agency/campaigns/cra-bizapp.html

- CRA Help Centre: https://www.canada.ca/en/revenue-agency.html

How Can I Obtain a CRA Security Code?

Here you can provide information and resources to guide you through the process.

Obtaining a CRA Security Code:

If you are already registered:

- Log in to your CRA account via My Account for Individuals, My Business Account, Represent a Client, the MyCRA app, MyBenefits CRA app, or the CRA BizApp.

- Follow on-screen instructions to request a new security code.

- The code will be displayed on your screen or sent to your preferred contact method (phone, email, etc.).

If you haven’t registered yet:

- Register for a CRA My Account. Follow the steps on the CRA website: https://www.canada.ca/en/revenue-agency/services/e-services/cra-login-services/cra-login-services-register-forgot-your-user.html

- During registration, you’ll receive a security code as part of the verification process.

Important Points:

- Expiry Date: The CRA security code has an expiry date, so use it before it expires.

- Mailing Option: You can request to have the code mailed, but this might take longer than electronic delivery.

- Accessibility: If you need the code in an alternate format due to visual impairment, contact the CRA directly.

Helpful Resources:

- CRA Website: https://www.canada.ca/en/revenue-agency/services/e-services/digital-services-businesses/register.html

- Help Centre: https://www.canada.ca/en/revenue-agency/services/e-services/cra-login-services/sign-partners-help-faqs.html

- Contact Information: 1-800-959-8281

Where Do I Enter My CRA Security Code?

After receiving your new CRA security code, follow these steps to enter it:

- Visit the CRA Sign-In Services Page:

- Go to the CRA sign-in services page by navigating to the official website.

- Choose the Appropriate Service:

- If you registered for a CRA user ID and password, select the “CRA Sign In” option.

- If you registered using the Sign-In Partner service, choose the “Sign-In Partner” option.

- Follow Online Instructions:

- Once you’ve selected the service, follow the instructions provided on the screen.

- The system will guide you through the necessary steps for logging in.

- Enter CRA Security Code:

- During the login process, you will be prompted to enter your CRA security code.

- Input the security code you received in the designated field.

- Complete the Login Process:

- Continue following the on-screen instructions to complete the login process.

- Ensure that you fulfill any additional authentication or verification steps if required.

By following these steps, you can successfully enter your CRA security code and access the CRA sign-in services based on the registration method you chose (CRA user ID and password or Sign-In Partner).

CRA Login Without Phone Number

To use CRA My Account, you now need to add a phone number for extra security. This is because of something called multi-factor authentication (MFA), which makes sure your account is really safe.

Here’s the key info about CRA login and multi-factor authentication:

What is MFA?

MFA means using two different ways to confirm it’s really you logging in. For CRA My Account, one of these ways must be a phone number.

Options for MFA:

- Phone call or text message: Most people use this option. You get a call or text with a code to enter.

- Security code generator: There’s an app you can use on your phone or tablet to create a code for login.

- Passcode grid: This is a paper with codes. You can use it if you don’t have a phone, but you need to get it and set it up ahead of time.

What if you don’t have a phone number?

- Get a prepaid phone: You can buy a simple phone just for getting MFA codes.

- Use a friend’s or family member’s number: You can use someone else’s phone, but make sure it’s okay with them and know it’s secure.

Important Things to Remember:

- Never share your MFA codes.

- Watch out for scams. The CRA won’t ask for your info through email or text.

- Update your phone number in CRA My Account if it changes.

Creating CRA Account

The Canada Revenue Agency (CRA) My Account is your personalized online space for securely managing your tax information and benefits. While the process might seem overwhelming initially, this guide aims to simplify the steps, covering eligibility criteria, required documents, and providing a comprehensive step-by-step walkthrough.

Eligibility: To create a CRA My Account, you should meet these basic requirements:

- Be a resident of Canada with a valid Social Insurance Number (SIN).

- Be 18 years of age or older.

- Have filed at least one Canadian tax return in the past two years.

Required Documents and Information: To complete the registration, gather the following:

- Your Social Insurance Number (SIN).

- Your date of birth.

- The amount reported on line 15000 of your most recent tax return (from either the current or previous tax year).

- An amount from one of your income tax and benefit returns (specific line varies by tax year).

- Your email address (optional but recommended).

Step-by-Step Guide: Follow these steps for a hassle-free registration:

- Visit the CRA website: Go to https://www.canada.ca/en/revenue-agency/services/e-services/digital-services-individuals/account-individuals.html.

- Select “Register for a CRA user ID and password.”

- Enter your SIN and date of birth.

- Enter the requested amounts from your tax return.

- Create your CRA user ID and password. Choose a strong, unique password and keep it confidential.

- Set up security questions and answers for future identity verification.

- Review your information and complete the registration.

- Optionally, verify your email address for enhanced security and electronic updates.

Additional Tips:

- Ensure you’re on the official CRA website by checking for the padlock symbol and verifying the website address.

- Never share your CRA user ID, password, or security code.

- Consider using a password manager for secure credential storage.

- Keep your software and antivirus updated for enhanced security.

- If you face difficulties during registration, contact the CRA at 1-800-959-8281.

By following these steps and considering security tips, you can create your CRA My Account seamlessly, ensuring secure online tax and benefit management. Prioritize the protection of your financial information throughout the process with vigilance and responsible password management.

Accessing CRA Login

The Canada Revenue Agency (CRA) Login portal serves as the gateway to your personal tax and benefit information, offering a convenient and secure online platform. This guide sheds light on its key features, user credentials, and the implemented two-step authentication process for enhanced security.

Overview of CRA Login Portal:

Picture a central hub where you can handle your tax affairs effortlessly – that’s the CRA Login portal. This secure online platform allows you to:

- View and Manage Tax Information: Access past and current tax returns, check assessments, and track refunds.

- File Taxes Electronically: Submit your tax return securely and conveniently online.

- Make Online Tax Payments: Settle your tax dues quickly through the portal.

- Register for Direct Deposit: Receive refunds and benefits directly to your bank account.

- Manage CCB Payments: Access Canada Child Benefit (CCB) information and update your contact details.

- Update Personal Information: Keep your profile current for smooth communication with the CRA.

User Credentials (Username and Password):

To access the CRA Login portal, you need two vital credentials:

- CRA User ID: Your unique username obtained through registration. Keep it strong and confidential.

- Password: A complex mix of uppercase and lowercase letters, numbers, and symbols. Keep it private and unique.

Two-Step Authentication Process:

For added security, CRA login includes a two-step authentication process:

Step 1: Username and Password Step 2: Verification Code via:

- Phone Call or Text Message: A code sent to your registered phone.

- Security Code Generator: An app on your phone or tablet.

- Passcode Grid: Pre-generated codes activated beforehand.

Enter the code received to complete the login, significantly boosting your account security.

Additional Tips:

- Prioritize Security: Never share credentials or verification codes.

- Watch for Phishing Scams: CRA won’t ask for info via email or text.

- Keep Software Updated: Ensure your device protection against potential threats.

- Use Strong Passwords: Consider a password manager for secure storage.

By understanding the CRA Login portal, user credentials, and the two-step authentication process, you can confidently manage your tax and benefit info online securely. Stay vigilant and responsible in safeguarding your personal data.

Features of CRA Login

The CRA Login portal is packed with useful features, making it easier for you to handle your tax and benefit information with the Canada Revenue Agency. Let’s break down these features in a simpler way:

Your Personal Tax Details:

- See and Manage Tax Returns: Check past and current tax returns, review assessments, and keep tabs on refund statuses.

- Monitor Your Tax Account: View your balance, check payment history, and understand any outstanding debts.

- Access Benefit Information: Handle Canada Child Benefit (CCB) payments, view Employment Insurance (EI) statements, and find other important benefit details.

- Get Personalized Notifications: Stay in the loop about deadlines, new messages, and upcoming tax-related events.

Access to Tax Documents:

- Download Tax Slips: Easily get T4 slips, RRSP contribution receipts, and other essential tax documents.

- Manage Tax Receipts: Store digital copies of your tax receipts securely within your account.

- Review Assessments: Understand your tax assessments and reassessments in detail.

- Check Correspondence: Stay updated with all CRA communication related to your taxes.

Online Services and Tools:

- E-File Your Tax Return: Submit your tax return safely and easily online.

- Make Online Tax Payments: Settle your tax payments quickly through the portal.

- Direct Deposit Registration: Get refunds and benefits straight into your bank account.

- Pre-Register for Auto-Filing: Simplify future filings by giving consent for pre-filled returns.

- Use Tax Calculators: Estimate taxes, potential refunds, and benefit eligibility.

Update Personal Info and Preferences:

- Manage Contact Details: Keep your address, phone number, and email updated for smooth communication.

- Update Marital Status and Dependents: Ensure your personal info matches your current situation.

- Manage Communication Preferences: Choose how you want to get updates and notifications.

- Represent a Client Access: Allow representatives to handle your tax affairs on your behalf.

Additional Resources:

CRA Login page: https://www.canada.ca/en/revenue-agency/services/e-services/cra-login-services.html

CRA My Account page: https://www.canada.ca/en/revenue-agency/services/e-services/digital-services-individuals/account-individuals.html

By using the CRA Login features, you can make managing your taxes and benefits easy and efficient. Just remember, your information is secure, and you have control over how you interact with the CRA.

Navigating the CRA Portal

The CRA Portal is like your online control center for managing your tax and benefit details. Although it might seem a bit tricky initially, this guide breaks down the main parts, making it easier for you to use confidently. Let’s explore the dashboard, menu options, and search tools to simplify your experience.

Dashboard Overview:

- Welcome Message: You get a friendly greeting with your name and important info.

- Key Account Details: Check your balance, recent payments, deadlines, and refund status.

- Quick Links: Find shortcuts for common actions like filing returns or managing benefits.

- Personalized Alerts: Stay updated on important CRA messages about your taxes.

Menu Options and Functions:

The menu is your guide to different features and services. Here’s what you can find:

- Tax Returns:

- File Return: Submit your tax info online.

- Review Returns: Look at past returns and check assessments.

- Manage Slips: Upload and keep important tax documents.

- Benefits:

- CCB: Manage Canada Child Benefit payments.

- EI: Access Employment Insurance statements.

- Other Benefits: Deal with GST/HST, Old Age Security, and more.

- Payments:

- Make a Payment: Settle your taxes online.

- Pre-authorized Payments: Automate future payments.

- Review Payment History: Check past payments and your account balance.

- My Profile:

- Update Personal Info: Make sure your contact details are up-to-date.

- Communication Preferences: Choose how you get updates.

- Security Settings: Keep your password and security preferences safe.

Searching for Specific Info:

If you need to find something specific, use the search bar:

- Keyword Search: Type in terms like “refund status” or “benefit payment.”

- Filter Results: Refine your search by tax year or type of information.

- Access Help: Get answers to common questions in the search results.

Extra Tips:

- Use the help section on most pages for guidance.

- Check the glossary for unfamiliar terms.

- Bookmark favorite sections for quick access.

- Remember, the CRA won’t ask for personal info through email or text.

By getting to know the dashboard, exploring menu options, and using the search feature, you’ll handle the CRA Portal like a pro. Just keep security in mind, and you’ll have a smooth and safe online experience.

Managing Personal and Business Tax Information

The CRA Portal simplifies the handling of personal and business tax information in one secure place. This guide breaks down the features for each, making it easy for you to navigate the portal smoothly and fulfill your tax duties effortlessly.

Personal Tax Information:

- Viewing Information:

- Tax Returns: Check past and current returns, assessments, and refund statuses.

- Tax Account: Keep tabs on your balance, payments, and any debts.

- Benefits: Manage CCB payments, view EI statements, and access other benefits.

- Correspondence: Stay updated on CRA communications regarding your taxes.

- Updating Information:

- Personal Details: Ensure your contact info is current for smooth communication.

- Marital Status and Dependents: Keep info accurate to reflect your situation.

- Communication Preferences: Choose how you receive CRA updates.

Business Functionalities:

- Business Section:

- GST/HST: Register, file returns, make payments, and manage GST/HST matters.

- Payroll: Electronically file T4 slips, report deductions, and manage payroll.

- Corporation Income Tax: File returns, view assessments, and make payments.

- Excise Duties: Register and manage duties related to your business.

Accessing and Filing Tax Returns:

- Electronic Filing:

- Personal Tax Returns: File securely online with pre-filled information.

- Business Tax Returns: Electronically submit GST/HST, payroll, and corporate income tax returns.

Additional Tips:

- Explore the help section for answers and instructions.

- Bookmark often-used sections for quick future access.

- Use the search bar for specific info.

- Remember, CRA won’t ask for personal info through email or text. Be cautious of scams.

By using the CRA Portal features, you can effectively handle both personal and business tax matters in one place. Keep info updated, use available resources, and prioritize security for a seamless and safe experience.

Security Measures

Using the CRA Login to manage your tax and benefits requires keeping things secure. Your login details are like a key to sensitive financial info, so it’s crucial to know and practice strong security measures. This guide breaks it down, explaining why security matters, giving tips for strong passwords, and helping you spot and avoid phishing attempts.

Why Secure CRA Login Matters:

- Identity Theft Risk: If someone unauthorized gets in, they might use your info for fake tax returns or benefits, leading to identity theft.

- Financial Consequences: Unauthorized access could mean fake transactions, unauthorized payments, or even stealing tax refunds.

- Credit Score Impact: Identity theft and fraud can hurt your credit score, making it harder to get loans or credit.

Taking steps to secure your CRA login helps reduce the chances of these problems and keeps your personal and financial info safe.

Tips for Strong Passwords:

- Length and Variety: Make your password at least 12 characters with a mix of uppercase, lowercase, numbers, and symbols.

- Avoid Personal Info: Don’t use birthdays, names, addresses, or common words in your passwords.

- Unique Passwords: Use different passwords for each account to add an extra layer of protection.

- Password Manager: Consider using a password manager to safely keep track of your complex passwords.

Spotting and Avoiding Phishing:

- Be Cautious of Emails and Texts: CRA won’t ask for personal info through these channels, so be suspicious of unexpected messages.

- Check Sender Details: Verify email addresses for authenticity, and watch out for misspelled domains.

- Avoid Clicking Suspicious Links: Hover over links to see the actual URL before clicking.

- Beware of Urgency: Phishing attempts often create urgency to pressure you into quick actions.

- Report Suspicious Activity: If you think it’s a phishing attempt, report it to the CRA right away.

Additional Security Tips:

- Enable Two-Factor Authentication: Add an extra layer of security by requiring a secondary code during login.

- Keep Software Updated: Regularly update your devices and software to fix vulnerabilities.

- Be Cautious on Public Wi-Fi: Avoid using your CRA login on public Wi-Fi for added security.

Understanding the need for security, using strong passwords, and being cautious about phishing ensures your CRA login is a strong defense against unauthorized access. Stay vigilant and manage your passwords responsibly to protect your financial well-being.

Troubleshooting and Support

Navigating the CRA portal is usually smooth, but occasional hiccups can occur. This guide provides insights into common login problems, steps to troubleshoot them, and how to reach out to CRA support if needed. Additionally, a quick FAQ section addresses common concerns for a speedy issue resolution.

Common Login Issues and Solutions:

- Incorrect Username or Password:

- Double-check for typos and ensure correct credentials.

- Consider using a secure password manager for storage.

- Two-Factor Authentication (2FA) Issues:

- Confirm your chosen verification method is available and working.

- Options include phone, security code generator, or passcode grid.

- Browser Compatibility Issues:

- Update your browser to the latest version.

- Ensure JavaScript is enabled.

- Test with a different browser to check for persistent issues.

- Account Lockout:

- Wait for the specified timeframe if you’ve entered incorrect credentials too many times.

- Try logging in again after the lockout period.

- Technical Difficulties:

- Check the CRA website for maintenance announcements.

- If the issue persists, try again later.

Contacting CRA Support for Assistance:

If the above solutions don’t resolve the problem, reach out to CRA support:

- Phone: Call 1-800-959-8281 during business hours.

- Online Form: Access the form on the CRA website.

- Social Media: Follow the CRA on Twitter or Facebook and send a message for assistance.

For a speedy resolution, follow these steps and don’t hesitate to contact CRA support if needed.

Future Developments and Updates

The Canada Revenue Agency (CRA) is always working to make its online services, especially the CRA Login portal, better. Knowing about possible improvements and future updates can help you use the portal more easily and handle upcoming changes with confidence.

Possible Improvements to CRA Login:

- Stronger Two-Factor Authentication (2FA):

- More secure options like fingerprint or facial recognition might be considered.

- Biometric Login:

- Login using fingerprints or facial recognition for a simpler yet secure process.

- User-Friendly Interface:

- Making the portal easier to use with a more straightforward design.

- Personalized Dashboards:

- Customized dashboards showing relevant info and deadlines for better efficiency.

- Integration with Banks:

- Secure connections with banks for automatic tax info and payments.

- Chatbot Support:

- An AI-powered chatbot to assist with common questions and tasks.

Coming Changes or Improvements:

- Accessibility Focus:

- Continuously working to make the portal accessible for users with disabilities.

- Mobile App Updates:

- Regular updates and new features for the CRA mobile app.

- Enhanced Security Measures:

- Implementing measures against phishing and unauthorized access.

- Improved Communication:

- Efforts to keep users informed about changes through various channels.

Staying Informed about CRA Updates:

To know about future changes to the CRA Login portal:

- Subscribe to CRA Emails: Sign up for email notifications on the CRA website.

- Follow CRA on Social Media: Get updates on Twitter or Facebook.

- Regularly Check CRA Website: Look at the News and Updates section for the latest info.

- Use CRA Help Centre: Find answers to common questions and detailed guides.

By keeping an eye out for information and understanding potential future changes, you can make the most of the CRA Login portal to manage your tax and benefit details securely and efficiently. Remember, staying informed and using secure practices lets you navigate the digital world with confidence.

FAQ

The CRA Login serves as a secure portal for accessing online services provided by the Canada Revenue Agency (CRA). It offers a user-friendly platform to conveniently manage both personal and business tax and benefit information. Here’s a breakdown of its key features:

Functionality:

- Personal Tax Information: Access and manage past and current tax returns, check balances, track refunds, handle RRSP contributions, and update personal details.

- Business Tax Information: File GST/HST returns, submit payroll remittances, monitor account balances, and access relevant tax documents.

- Benefits: View and manage Canada Child Benefit (CCB) payments, access Employment Insurance (EI) statements, and update benefit information.

- Payments: Make secure payments for tax dues using various methods.

- Communication: Receive personalized messages and notifications from the CRA about tax and benefit matters.

Benefits of Using CRA Login:

- Convenience: Manage tax and benefit information anytime, anywhere with an internet connection.

- Accessibility: Access a wide range of services and information in one central location.

- Security: Robust security measures protect sensitive financial data.

- Efficiency: Eliminate the need for paper forms and simplify tax management.

Getting Started:

- Existing User: Log in directly through the CRA Login portal if you already have a CRA user ID and password.

- New User: Register for a My Account through the CRA website at <valid URL>.

Important Points:

- Security: Beware of phishing scams and avoid sharing CRA login credentials.

- Two-Factor Authentication: Consider enabling two-factor authentication for added security.

- Mobile App: Business owners can use the CRA BizApp for a mobile-friendly experience.

The CRA Login is open for use by a diverse range of individuals and entities in Canada, including:

Individuals:

- Canadian citizens and residents: Access personal tax details, file tax returns, manage RRSP contributions, view benefit information, and update personal details.

- Non-residents with tax obligations in Canada: File tax returns, report Canadian income, and make payments.

- Representatives of deceased individuals: File final tax returns, manage tax affairs, and access relevant information.

Businesses:

- Sole proprietors and small business owners: File GST/HST returns, make payroll remittances, manage account balances, and access tax documents.

- Corporations and partnerships: File corporate tax returns, manage accounts, and access relevant information.

- Charities and non-profit organizations: Register, file returns, and access information related to tax-exempt status.

Other Users:

- Authorized representatives: Accountants, lawyers, and professionals can access client information with proper authorization.

- Government agencies: Authorized officials can access information for official purposes.

Restrictions:

- Minors: Children under 18 generally cannot independently use CRA Login. Legal guardians or parents may manage their tax affairs through their own CRA Login.

- Individuals without Canadian tax obligations: Those without Canadian tax obligations won’t benefit from using CRA Login.

Additional Notes:

- To unlock the full range of features, registration for a My Account is essential.

- Different registration processes exist for individuals, businesses, and representatives.

There are two primary methods to enter the CRA Login:

- Through the CRA Website:

- Visit the official CRA Login website.

- If you already have a My Account, input your CRA user ID and password.

- If unregistered, click on “Register” and follow the prompts to create a My Account.

- Upon logging in, access the various services and information provided by the CRA Login portal.

- Through the MyCRA Mobile App:

- Download the free MyCRA mobile app for iOS or Android devices.

- For existing My Account users, log in using your current credentials.

- If not registered, create a My Account directly within the app.

- The MyCRA app offers a subset of features compared to the full CRA Login website but allows convenient access to essential tasks on the go.

Important Reminders:

- Security: Always ensure you access the official CRA website or app. Avoid clicking on suspicious links or responding to emails claiming to be from the CRA.

- Two-Factor Authentication: Consider enabling two-factor authentication for enhanced security during login.

- Accessibility: Both the website and app incorporate features for users with disabilities.

The information accessible through CRA Login varies depending on your status and account type. Here’s a breakdown:

For Individuals:

- Personal Tax Information:

- View past and current tax returns.

- Check balances and track refunds.

- Manage RRSP contributions and investment income.

- Update personal details and contact information.

- Benefits:

- View and manage Canada Child Benefit (CCB) payments.

- Access Employment Insurance (EI) statements.

- Update benefit information.

- Other:

- File tax returns electronically.

- Make secure payments for tax dues.

- Receive personalized messages and notifications from the CRA.

- Manage communication preferences.

For Businesses:

- Business Tax Information:

- File GST/HST returns.

- Submit payroll remittances.

- Monitor account balances and transaction history.

- Access relevant tax documents.

- Other:

- Register for a business number.

- Update business information.

- Communicate with the CRA regarding tax matters.

For Representatives:

- Access information and manage tax affairs for clients with proper authorization.

- Accountants and lawyers acting on behalf of individuals or businesses.

- Trustees, executors, and administrators representing deceased individuals.

Additional Notes:

- Specific information available may vary based on individual circumstances.

- Some features require additional verification or authorization.

- Manage access and permissions within your My Account settings.

Remember, CRA Login is a valuable tool for managing your tax and benefit information. Explore its features and customize your access based on your needs.

The CRA Login prioritizes security for individuals and businesses managing tax and benefit information. Here’s an overview of the security measures in place:

Security Features:

- User Authentication:

- Implements strong password requirements.

- Utilizes two-factor authentication (2FA) and sign-in partner options for secure access.

- Data Encryption:

- Ensures sensitive information transmitted and stored is encrypted using industry-standard protocols.

- Security Protocols:

- Implements various security measures on the CRA website and app to safeguard against cyberattacks and unauthorized access.

- Regular Audits and Updates:

- Undergoes frequent security audits and updates to address vulnerabilities and enhance overall security.

Additional Precautions:

- Be Vigilant:

- Exercise caution regarding phishing scams and never share CRA login credentials.

- Use Strong Passwords:

- Create complex and unique passwords for CRA accounts; enable 2FA for added protection.

- Keep Software Updated:

- Ensure the device’s operating system and browser have the latest security patches.

- Avoid Public Wi-Fi:

- Refrain from accessing CRA accounts on public Wi-Fi networks due to potential security risks.

- Report Suspicious Activity:

- Report any suspected unauthorized access or phishing attempts to the CRA promptly.

While the CRA maintains robust security measures, it’s essential to recognize your role in staying protected. Practicing responsible password hygiene, avoiding risky online behavior, and staying informed about potential threats can further enhance security on the CRA Login platform.

External Resources:

- CRA Login Security Overview: https://www.canada.ca/en/revenue-agency/services/e-services/cra-login-services/cra-user-password-help-faqs/registration-process-access-cra-login-services.html

- Canada.ca Security Tips: https://www.cyber.gc.ca/en

- Government of Canada Phishing Awareness: https://www.cyber.gc.ca/en/guidance/dont-take-bait-recognize-and-avoid-phishing-attacks

Remember, cybersecurity is a shared responsibility. By following best practices and exercising caution, you contribute to a secure online experience on the CRA Login platform.

If you happen to forget your CRA User ID or password, no need to worry! The CRA provides simple steps to recover both:

Forgotten User ID:

- Visit the CRA Login Page: [https://www.canada.ca/en/revenue-agency/services/e-services/cra-login-services/cra-login-services-forgot-your-userid.html]

- Choose the service you registered with (e.g., My Account for Individuals, Represent a Client, etc.).

- Click “Forgot your user ID?” on the login page.

- Follow the on-screen instructions, providing necessary details like your social insurance number (SIN) and date of birth.

- The CRA will send your User ID to your registered email address.

Forgotten Password:

- Visit the CRA Login page.

- Choose the service you registered with.

- Click “Forgot your password?” on the login page.

- Select your reset method:

- Answer your secret questions: If set up during registration, use them to reset your password.

- Receive a security code: If you don’t remember secret questions, a security code will be sent to your registered email or phone.

- Follow on-screen instructions, entering the security code or answering questions to reset your password.

Important notes:

- If unable to access your registered email or phone, contact the CRA directly by phone.

- Remember and protect your new User ID and password; consider using a password manager.

- For enhanced security, enable two-factor authentication (2FA) on your CRA account.

Additional resources:

- CRA Help Centre: https://www.canada.ca/en/revenue-agency.html

- Contact the CRA: 1-800-959-8281

Remember, the CRA will never request your password or personal information through email or phone calls. Stay vigilant and report any suspicious activity.

An ACWB notice from the CRA refers to the Advanced Canada Workers Benefit notice, an official communication from the Canada Revenue Agency (CRA). It informs eligible individuals about their estimated payments for the Advanced Canada Workers Benefit (ACWB).

What is the ACWB? The ACWB is a refundable tax credit introduced by the Canadian government in 2023 to financially assist low- and middle-income workers and families. Unlike waiting until tax return filing, it provides an advanced payment of a portion of the Canada Workers Benefit (CWB) throughout the year.

Information in the ACWB Notice: The ACWB notice typically contains the following details:

- Your estimated annual eligibility for the CWB.

- The amount of each ACWB payment you will receive (usually three payments).

- Payment dates for your ACWB installments.

- Your contact information with the CRA.

Important Considerations:

- It’s not a tax return document; you don’t need to file it with your tax return.

- Estimated amounts may change based on your income and circumstances during the year, with a final adjustment upon tax return filing.

- If you disagree with the information, you can contact the CRA.

- If you haven’t received a notice but believe you’re eligible for the ACWB, check eligibility and register on the CRA website.

If your CRA account is locked, unlocking it depends on the reason behind the lock. Follow these steps:

If locked due to incorrect login attempts:

- Wait 24 hours: Allow the lock to expire automatically by waiting for 24 hours.

- Reset your password:

- Remember security questions? Reset your password on the CRA Login page. Click “Forgot your password?”, choose “Answer your secret questions,” and follow on-screen instructions.

- Forgot security questions? Request a security code on the “Forgot your password?” page, and the CRA will send a code to your registered email or phone. Use it to reset your password.

- Contact the CRA: If online methods fail, contact the CRA at 1-800-959-8281 to reset your password.

If locked for another reason:

- Check for messages: Look for CRA messages explaining the lock and necessary steps in your email or My Account inbox.

- Contact the CRA: If no messages or uncertainty about the lock reason, reach out to the CRA directly at 1-800-959-8281.

Additional considerations:

- Beware of phishing scams: Never share your CRA login details, security code, or personal information via email, phone, or text. The CRA never requests such information through these channels.

- Protect your password: Create a strong, unique CRA account password, avoiding repetition across online accounts. Consider a password manager for secure storage.

- Enable two-factor authentication: Add an extra layer of security by enabling two-factor authentication, requiring a second factor like a phone-sent code alongside your password.

Certainly! The Canada Revenue Agency (CRA) offers two mobile applications:

- MyCRA:

- Target audience: Individuals

- Key features: View recent tax information, pay tax balance, check RRSP contribution room, manage Canada Child Benefit (CCB), and Employment Insurance (EI) statements.

- Registration requirement: My Account with the CRA

- Availability: Free download on iOS and Android devices.

- BizApp ARC:

- Target audience: Small businesses and sole proprietors

- Key features: File GST/HST returns, submit payroll remittances, view account balances, and access relevant tax documents.

- Registration requirement: My Business Account with the CRA

- Availability: Free download on iOS and Android devices.

Summary:

| Feature | MyCRA | BizApp ARC |

|---|---|---|

| Target audience | Individuals | Small businesses and sole proprietors |

| Key features | View tax information, pay taxes, manage benefits | File GST/HST returns, submit payroll remittances, view account balances |

| Registration requirement | My Account with the CRA | My Business Account with the CRA |

| Available on | iOS, Android | iOS, Android |

No, the CRA Login website does not directly process payments. However, it serves as a portal to various features that facilitate payments for your tax obligations and other charges. Here’s how the CRA Login supports payments:

1. View and Manage Balances:

- Access your individual or business account information on the CRA Login platform, including current tax balances and applicable fees.

2. Initiate Payment Requests:

- Utilize different methods to initiate payment requests, such as:

- My Payment: A secure service integrated with the CRA Login platform, enabling direct payment using your debit card.

- Interac e-Transfer: An option for those who prefer using their online banking service.

- Credit Card Payment: Some financial institutions allow credit card payments for CRA dues, usually with additional fees.

- Cheque: While not encouraged, mailing a cheque remains an option, although it may take longer to process.

3. Track Payment Status:

- Monitor the status of your submitted payments within the CRA Login platform.

Important notes:

- Payment methods may vary based on your location, account type, and payment amount.

- The CRA encourages electronic payment methods for faster processing and reduced environmental impact.

- Double-check payment details before submission to ensure accuracy.

Additional resources:

- My Payment service: https://www.canada.ca/en/revenue-agency/services/e-services/payment-save-time-pay-online.html

Remember, while the CRA Login does not directly process payments, it acts as a central hub for managing your tax information and provides secure and convenient options for meeting your financial obligations to the agency.

When generating your CRA user ID and password, it is recommended to:

- Make them memorable for you but challenging for others to guess.

- Avoid incorporating personal details such as your name, social insurance number, mailing address, or email address.

- Always use unique passwords for both your CRA and online banking accounts. Refrain from reusing the same password across different accounts or systems.

- Keep this information secure and refrain from sharing it with anyone.

To successfully create your CRA user ID and password, adhere to the following rules:

CRA User ID:

- Must consist of 8 to 16 characters (no spaces).

- Can contain up to seven digits.

- Acceptable special characters include: dot (.), dash (-), underscore (_), and apostrophe (‘).

Note: Each CRA user ID must be unique, and you will receive a notification if the chosen ID is already in use.

Password:

- Should be between 8 and 64 characters.

- Must include one upper-case letter, one lower-case letter, and one digit.

- No spaces or accented characters are allowed.

- Acceptable special characters include: dot (.), dash (-), underscore (_), and apostrophe (‘).

- Prohibits the use of more than 4 consecutive identical characters.

- Ensure that the password and confirm password match.

If you’ve forgotten your CRA user ID for any of the following CRA sign-in services, you can recover it:

- My Account: https://www.canada.ca/en/revenue-agency/services/e-services/digital-services-individuals/account-individuals.html

- My Business Account: https://www.canada.ca/en/revenue-agency/services/e-services/digital-services-businesses/business-account.html

- Represent a Client: https://www.canada.ca/en/revenue-agency/services/e-services/represent-a-client.html

- Sign in to MyCRA: https://www.canada.ca/en/revenue-agency/services/e-services/digital-services-individuals/mycra.html

- Sign in to MyBenefits CRA: https://www.canada.ca/en/revenue-agency/services/e-services/mybenefits-cra.html

- Sign in to CRA BizApp: https://www.canada.ca/en/revenue-agency/services/e-services/digital-services-businesses/cra-biz-app.html

- Change my direct deposit: https://www.canada.ca/en/revenue-agency/services/e-services/auto-fill-return-express-noa/cra-register.html

- Change my address: https://www.canada.ca/en/revenue-agency/services/e-services/auto-fill-return-express-noa/cra-register.html

To recover your user ID, go back to the service you want to use, select “CRA sign in,” and on the CRA sign-in page, click “Forgot your user ID?” Follow the provided instructions.

If you’ve forgotten your CRA user ID for the Tax information web service (including Auto-fill my return, T2 Auto-fill, Express NOA, Account Information Retrieval Service, Canada Digital Adoption Program, and Identity validation service), you cannot recover it. You need to contact the CRA to register again.

For the Candidate profile service, if you’ve forgotten your CRA user ID, complete the candidate profile recovery process to create a new CRA user ID, linking it to your existing candidate profile.

Candidate profile recovery:

- If you’re a new user, register before using the Candidate profile service.

CRA Password:

If you’ve forgotten or misplaced your CRA password, you can create a new one by correctly answering the security questions you selected during registration. To create a new password, go back to the service, select “CRA sign in,” and on the CRA sign-in page, click “Forgot your password?” Follow the provided instructions.

Upon completing the registration process through My Account for Individuals, My Business Account, Represent a Client, the MyCRA app, MyBenefits CRA app, or the CRA BizApp, you will receive a CRA security code. The code comes with a specified expiry date, and it is crucial to follow the provided instructions before this date. Failure to use the code in time will require you to contact us for the issuance of a new CRA security code.

If you opt to receive the CRA security code by mail, it will be sent to the address on file. In case you have Recently Moved[https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/personal-address-information/you-have-moved.html], ensure your address is up-to-date. For individuals who are blind or partially sighted, Alternative Formats[https://www.canada.ca/en/revenue-agency/services/forms-publications/help-forms-publications/about-multiple-formats.html] for personal correspondence from the CRA can be requested.